Are you meeting the new transparency requirements?

July 01, 2019Did you know that U.S. Federal Physician Payments Sunshine Act (Open Payments) recently changed to include nurses? Are you aware of the new Colorado and New Jersey laws and that the Massachusetts deadline is approaching? Are you aware of international requirements?

- The SUPPORT for Patients and Communities Act was signed into law by President Trump on October 24, 2018, which includes a section on Fighting the Opioid Epidemic with Sunshine.

- The law expands the definition of “covered recipient” to include the following types of health care professionals: physician assistants, nurse practitioners, clinical nurse specialists, certified nurse anesthetists, and certified nurse-midwives.

- Companies should begin updating their compliance programs and processes to accommodate the expanded reporting scope. The law becomes effective January 1, 2022. It remains unclear whether tracking will start in 2021 or 2022. We are watching for announcements from CMS.

- New Jersey recently finalized its gift ban amendments.

- A new Colorado law requires drug companies to provide pricing and generic information to prescribers.

- The Massachusetts registration/renewal compliance filing and payment is due by August 31st. International requirements are extensive and continued to expand.

Transparency Best Practices

- In order to comply with the litany of requirements, manufacturers are encouraged to implement robust policies and procedures to help them keep track of and comply with these new requirements.

- Communicating the rules to affected employees is critical.

- Best practice also includes implementing a reliable system used by staff to document and aggregate transactions for reporting.

- Some companies opt to track and report data manually, while others use third-party transparency reporting software.

- Reporting and registration requirements should be systematized, e.g., via the Quality Management System to ensure deadlines are not missed and information is reported properly.

Are you complying with applicable municipal, state, federal, and international requirements?

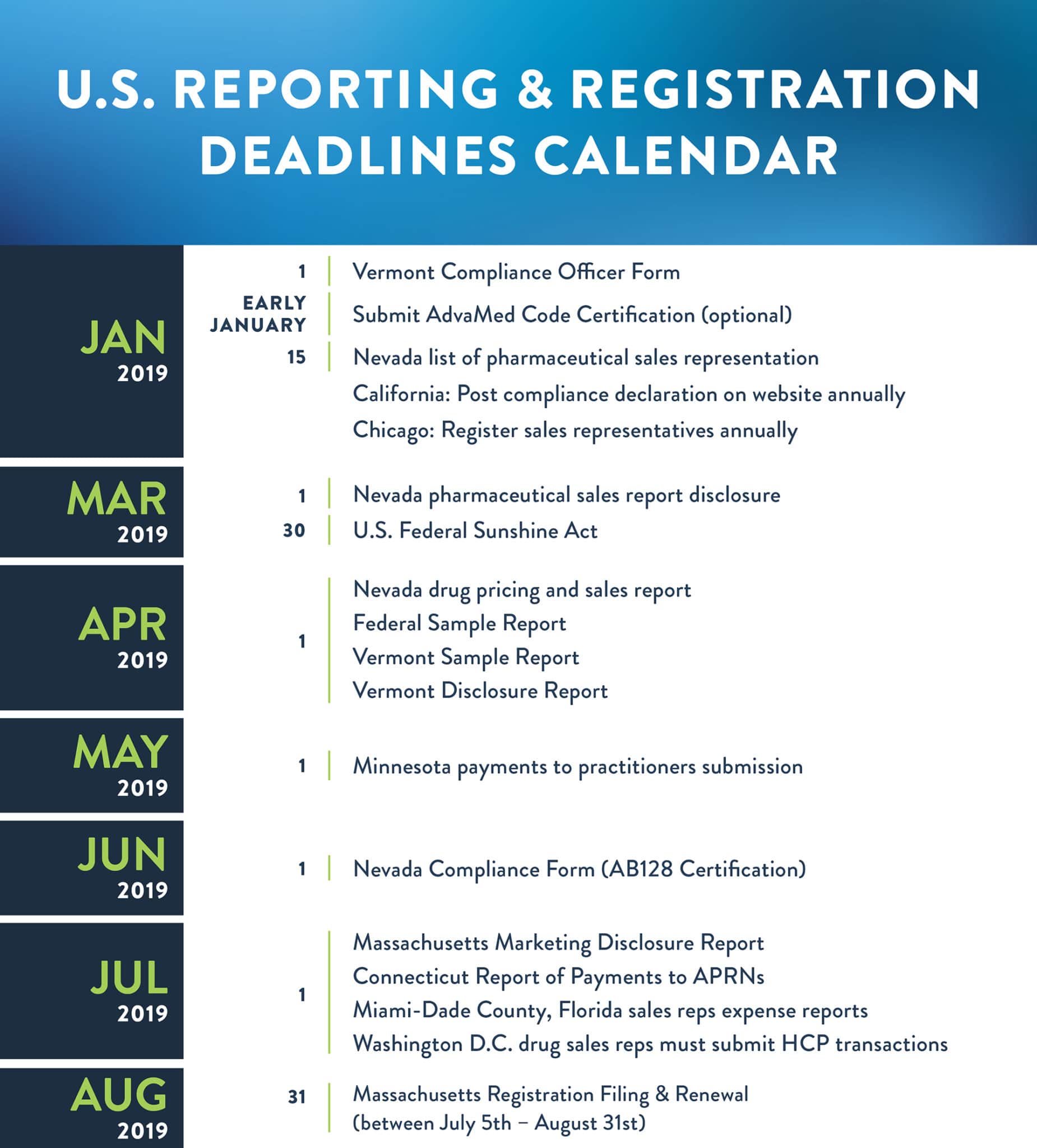

- We’ve outlined these below and included a calendar listing reporting deadlines.

- Many jurisdictions have current or pending legislation that impact how companies market products and interact with health care professionals.

- Manufacturers need to be aware of these in order to avoid fines and to maintain compliance.

- Some states have actively enforced their laws, e.g., Vermont settled with twenty-five drug and device makers for failing to report and for alleged gift ban violations.

- Fines range by jurisdiction but are as high as $10,000 per violation.

- Requirements vary and include gift bans and limitations, payment and marketing disclosures, manufacturer and/or sales staff registration, and compliance attestations—made under penalty of perjury.

- We’ve outlined international requirements below.

U.S. Overview of requirements

California (applies to drug & device makers)

- Manufacturers must annually declare compliance to its Comprehensive Compliance Program (that complies with California law) on its website, including the specification of an annual dollar limit on HCP spending, among other requirements. The law does not specify a deadline.

Chicago (only applies to drug makers)

- Pharmaceutical sales representatives must be licensed by the Department of Business Affairs and Consumer Protection prior to doing business in Chicago and pay an annual fee of $750 per person.

- While Chicago does not require regular reporting of transfers of value, pharmaceutical sales representatives must keep a log of all interactions with HCPs that take place in Chicago. The log must be submitted within 30 days of a request made by the Commissioner. There are exceptions for activities at symposia, conferences, and large events.

NEW – Colorado (drug only)

- When providing information about a drug to a prescriber, manufacturers must provide the following information in writing:

- The wholesale acquisition cost of the drug; and

- The names of at least three generic prescription drugs from the same therapeutic class (or as many as there are available).

Connecticut (drug & device)

- Disclosure Report of Payments to Advanced Practice Registered Nurses (APRNs) due annually by July 1st.

- Manufacturers must adopt sales and marketing policies that are minimally consistent with AdvaMed or PhRMA and establish a compliance program in accordance with the guidelines provided in the Office of Inspector General Compliance Program Guidance for Pharmaceutical Manufacturers.

District of Columbia (drug only)

- Pharmaceutical sales representatives must be licensed in the District prior to performing detailing services and pay a fee of $175 per person. Licenses must be renewed every two years.

- Report certain HCP activities in the District and transactions involving HCPs and pay a $5,000 fee annually by July 1st.

- Reporting threshold: $25 or more.

Massachusetts (drug & device)

- Marketing Disclosure Report due annually by July 1st.

- Reporting threshold: $50 or more.

- DEADLINE APPROACHING: Registration/Renewal Compliance Filing Form for Manufacturers and payment of $2,000 fee annually between July 5th and August 31st.

Miami–Dade County, Florida (drug & device)

- Sales representatives must register and pay fee of $490 per person prior to performing any sales activities in the County.

- Sales representatives must submit a report of expenditures associated with sales activities annually by July 1st.

- Reporting threshold: $25 or more.

Minnesota (drug only)

- Wholesale drug distributors and manufacturers must file an annual report with the Board of Pharmacy annually by May 1st identifying certain payments made to practitioners.

- Reporting threshold: $100 or more.

NEW – New Jersey (drug only)

- The rule imposes dollar limits on meals provided to New Jersey HCPs ($15 for breakfast & lunch, $30 for dinner) during promotional activities. The meal limits do not apply to “educational events.”

- New Jersey also limits payments that New Jersey HCPs may receive from all pharma manufacturers for “bona fide services” to $10,000 per calendar year. Compensation for research activities and speaking at educational events are excluded from the cap.

Nevada (drug & device)

- Compliance Form for Manufacturers and Wholesalers of Drugs, Medicines, Chemicals, Devices, or Appliances/AB128 Certification of Completion of Annual Audit due annually by June 1st.

- Manufacturers must submit a list of names of all pharmaceutical sales representatives who market prescription drugs in Nevada. The list must be kept current and updated at least annually by January 15th.

- Manufacturers of certain prescription drugs identified by Nevada must submit a pricing and sales report annually by April 1st (drug-only requirement).

- Pharmaceutical sales representatives identified by Nevada must submit a sales report disclosure annually by March 1st (drug-only requirement).

- Reporting threshold: $10/item, $100/year.

Vermont (drug & device)

- Compliance Officer Form must be filled out and payment of $500 fee made by January 1st.

- Vermont Sample Report due annually by April 1st (for preceding calendar year).

- Report certain information about all samples of OTC drugs and prescription biologics or devices given to Vermont HCPs, including product, dosage, unit, and recipient information.

- Disclosure Form for Manufacturers of Prescribed Products due annually by April 1st.

- Reporting threshold: $0.

- Vermont has a strict “gift ban” that prohibits providing food to any Vermont HCP or their staff, paying a Vermont HCP for participating in a market research or marketing survey, giving a discount coupon or voucher to HCPs for a conference or annual meeting, among other things.

U.S. Federal Physician Payments Sunshine Act/Open Payments (drug & device)

- Transparency reports and reporting of physician ownership interests submitted annually by 90th day of the year.

- Reporting threshold: $10.79/item, $107.91/year (2019).

U.S. Federal Sample Report (drug only)

- Federal Sample Report due annually by April 1st for the preceding calendar year.

- Manufacturers must report the identity and quantity of prescription drug samples requested and distributed annually, including recipient information.

NEW – U.S. Federal Prescription Drug Sunshine, Transparency, Accountability, and Report (“STAR”)

- The STAR Act, which was unanimously passed by the House Ways & Means Committee and introduced in the House of Representatives on April 8, 2019, is intended to address perceived high costs of prescription drugs, provide insight across the health care supply chain and ultimately reduce costs.

- The STAR Act also applies to device manufacturers for certain requirements but is primarily focused on the drug industry.

- If it becomes law, the STAR Act would require the following:

- Drug manufactures to publicly justify large price increases for existing drugs as well as high launch prices for new drugs.

- Drug and device manufacturers to report the total aggregate monetary value and quantity of samples provided to covered entities.

- Drug manufactures to submit the average sales prices for physician-administered drugs covered under Medicare Part B.

- Several national organizations (AARP, American Hospital Association, ERISA Industry Committee, National Community Pharmacists Association, and Federation of American Hospitals) support the STAR Act.

International Transparency Reporting Requirements

Australia

- Medicines Australia Code reports due annually by end of February and August.

Belgium

- Transparency reports due annually by May 31st.

Brazil

- Sponsorship of scientific exchange and conflict of interest reports due annually on the last business day of January.

Canada

- Innovative Medicines Canada voluntary disclosure of payments to HCPs due annually in June.

- NOTE: Ontario has a pending transparency reporting law not yet in effect.

Colombia

- Semi-annual reports before September and before April.

Croatia

- Code of Conduct of Innovative Pharmaceutical Companies disclosure due annually by end of June.

Cyprus

- KEFEA Code of Conduct disclosure report due annually by end of June.

Czech Republic

- AIFP transparency report due annually by end of June.

- Czechmed Code report due annually by end of February.

Denmark

- HCP Affiliation reports must be submitted to Danish Health and Medicines Authority due annually by January 31st.

European Federation of Pharmaceutical Industries and Associations (EFPIA)

- Under the EFPIA Disclosure Code, EFPIA members companies must publicly disclose certain payments they make to HCPs, e.g., sponsorships to attend meetings, speaker fees, consultancy and advisory boards due annually by June 30th.

Estonia

- APME Code disclosure due annually by end of June.

- Support to HCPs disclosure report due annually by February 1st.

Finland

- Pharma Industry Finland Code and MedTech Finland disclosures due annually by end of June.

France

- Loi Bertrand reports are due semi-annually by March 1st and September 1st.

Germany

- FSA and AKG transparency disclosures due annually by end of June.

Greece

- FSA and AKG transparency disclosures due annually by end of June.

Hungary

- AIMP Transparency Code disclosures due annually by end of June.

Iceland

- Frumtok Code disclosure due annually by end of June.

Indonesia

- Companies must report sponsorships and support of HCPs and originations to the Corruption Eradication Commission within thirty (30) days of payment.

Ireland

- Irish Pharmaceutical Healthcare Association (IPHA) Code disclosures due annually by end of June.

Israel

- Reports to the National Health Insurance Law via Ministry of Health Website due annually by March 1st.

Italy

- Reports of consulting fees paid to HCPs employed by the National Health Service are due to the applicable local health units within fifteen (15) days of payment.

- Farmaindustria Code and Assobiomedica Code disclosures due annually by end of June.

Japan

- Members of the Japan Medical Device trade association (JFMDA) must publish transparency reports on their company website annually pursuant to JFMDA Code.

Latvia

- Disclosures due annually by the end of March and SIFFA Code disclosures due annually by end of June.

Lithuania

- HCP/HCO Disclosure Code reports due within 6 months after the end of the relevant reporting period.

Malta

- PRIMA Code disclosure due annually by end of June.

Medicines for Europe

- Code disclosures due annually by end of June.

MedTech Europe

- Members must disclose certain contributions to medical education annually by June 30th.

Middle East

- MECOMED disclosure due annually by end of June.

Netherlands

- Members of a Dutch industry association are required to report annually by May 31st.

- Non-members may report voluntarily.

Norway

- LMI Rule disclosures due annually by end of June.

Philippines

- Notice of Meetings due one month prior to the event

Poland

- INFAMRA Disclosure Code report due annually by end of June.

Portugal

- Companies subject to the reporting obligations must register and report transfers of value to HCPs and organizations within thirty (30) days of payment.

Romania

- HCP sponsorship reports are due to ANMDM annually by March 31st and must be published on the company’s website by October 31st.

Russia

- AIPM Code disclosure due annually by end of June.

Serbia

- INOVIA disclosures due within 6 months from the expiration of each reporting period.

Slovakia

- AIFP Code disclosures due end of January and end of July.

Slovenia

- EIG disclosure code reports due annually by end of June.

South Korea

- Reports are due annually by March 31st for companies that have a fiscal year end of December 31st.

- For other companies, reports are due three (3) months after the end of a Company’s fiscal year.

Spain

- Code disclosures due annually by end of June.

Sweden

- LIF Code disclosures due within 6 months from the expiration of each reporting period.

Switzerland

- Pharma Code disclosures due annually by end of June.

- Disclosures due annually by to Swiss MedTech by June and published on own website by August.

Turkey

- Disclosure report due annually by end of June.

Ukraine

- APRAD Code disclosures due annually by end of June.

United Kingdom

- ABPI Code disclosure submission due by the last working day in March.

- ABHI Code disclosure submission due annually by end of June.